With the end of the 2017/18 financial year, now is a good time to take stock of some critical regulatory requirements to keep in mind as you prepare your clients for SMSF audit season.

Contributions

The following changes on contribution came into effect as of 1 July 2017; please ensure these are reviewed prior to the audit:

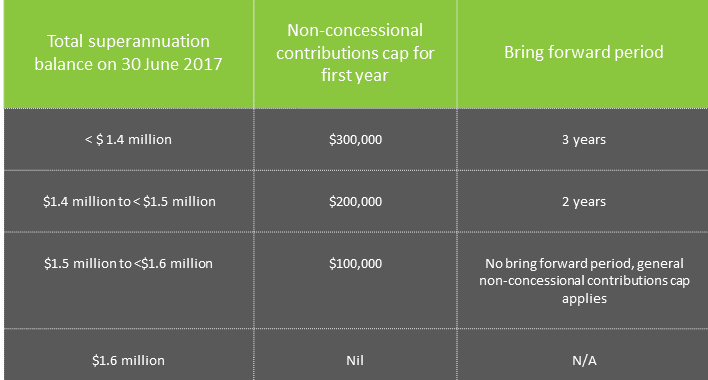

Non-Concessional Contribution: 2017-18 Bring forward period

Transfer Cap Limit

Effective 1 July 2017, there is a limit on how much of your super you can transfer from your accumulation super account into the tax-free ‘retirement phase’ account to receive your pension income.

This limit is known as the ‘transfer balance cap’. The cap only relates to the amount you transfer and hold in retirement phase accounts; there is no limit on the amount of money you can hold in your accumulation super account.

The transfer balance cap will start at $1.6 million and applies to all retirement phase income streams – both those commenced before and after 1 July 2017.

Your personal transfer balance cap is determined based on a number of things, including:

- General transfer balance cap at the time you first commenced retirement phase pension

- Any indexation that may be applied to the general transfer balance cap

- Total amounts you have used to commence retirement phase pensions

If the total amount in your pension account grows over time through investment earnings to more than $1.6 million, you won’t exceed your cap. If the amount in your pension account goes down over time, you can’t ‘top it up’ if you have already used your cap.

If you exceed your transfer balance cap, you may have to remove the excess from one or more retirement phase income streams and pay tax on the notional earnings related to that excess.

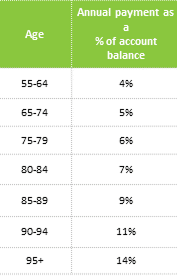

Pension

Super funds with pension will need to ensure the minimum and maximum pension limits are met.

TRIS

Commencing in 2017-18, partial commutations (i.e. lump sum withdrawals from a pension) no longer count towards the minimum annual pension payment.

- Members between the preservation age can no longer elect to treat taxable pension payments as lump sums to receive the tax free threshold using the low rate cap; if your fund is running a TRIS, ensure the maximum pension payment is not exceeded. Also commencing from 2017-18, fund earnings and capital gains on assets supporting a TRIS are no longer tax-free.

If conditions of release are not met, will not be eligible for ECPI.

Trustees can no longer use the segregated method for determining exempt current pension where:

- the fund has a member in retirement phase.

- as at 1 July 2017 either that member, or another member, has a total super balance of more than $1.6 million including a retirement phase income stream, even if that income stream is paid from another fund.

Where these factors apply the fund must obtain an actuarial certificate to determine the percentage that is tax exempt.

Asset Valuation

Ensure all assets held by the super fund are valued at the market value; this also applies to any properties and investments held in any unlisted unit trusts that the super fund is a unitholder of. Additionally will need to also ensure that the value of any in-house assets is less than 5% of the total value of the fund.

We suggest engaging a real estate agent to provide an estimate of the market rental income and a property valuation.

Sundry Debtors

Any unpaid distributions, rent or interest income receivable by the super fund will need to be settled prior to the audit. If the payments are received after the year end, ensure bank statements are provided to substantiate this.

Lease & Loan Agreements

If the super fund holds investment properties, ensure all the lease agreements pertaining to this are prepared and updated

If there are non-related party loans, loan agreements will need to be drafted and held on file.

Unsigned Permanent Documents

Ensure all permanent documents such as trust deeds, trustee declarations etc are signed and executed.

Life Insurance

Funds with life insurance generally receive premium and insurance confirmation letters from the insurer. Ensure these documents are reviewed and attached to the audit file along with the other supporting documents.

Software Migration

Clients who have migrated to a new accounting software during the 2017/18 financial year must ensure all the opening balances on the system agree to the prior year audited financial statements.

Investment Strategy

Update the Investment Strategy and ensure appropriate consideration is given to the investment risks and the insurance.

Arm’s Length

If there is any rental income, review to ensure the income is updated in line with the lease agreement Ensure consideration is given to the relevant market interest rates when determining the arm’s length interest rate on loans to non-related party

Management Letter

Review the prior year management letter and ensure all the matters addressed are fixed prior to the next audit.